The Ultimate Guide To Paul B Insurance

Today, property owner, car owners, businesses and institutions have readily available to them a wide variety of insurance coverage items, several of which have ended up being a requirement for the performance of a free-enterprise economy. Our culture might rarely work without insurance policy. There would certainly a lot unpredictability, so much exposure to abrupt, unexpected potentially catastrophic loss, that it would certainly be tough for any person to intend with confidence for the future.

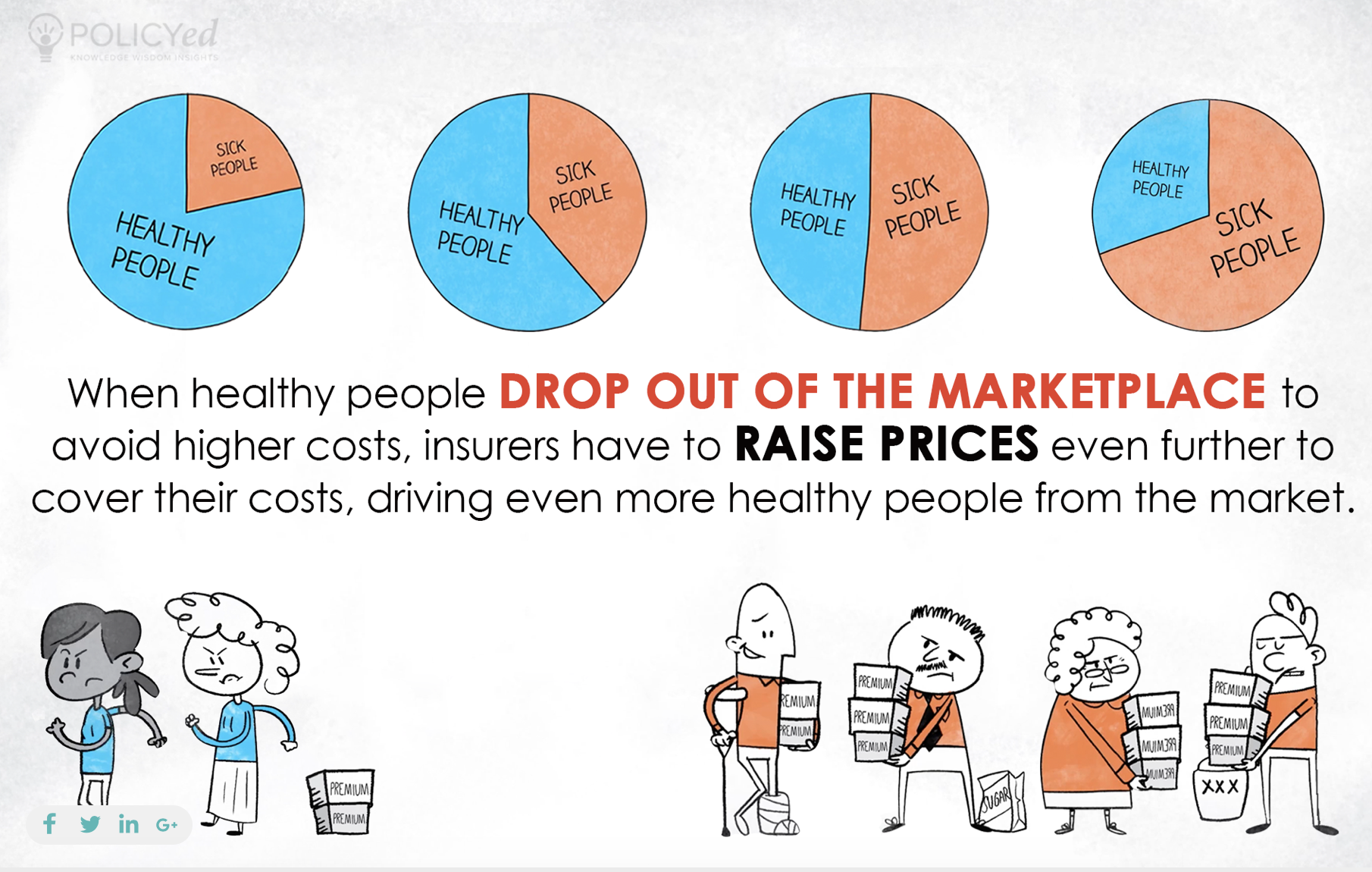

The bigger the number of premium payers, the much more properly insurance providers have the ability to estimate likely losses hence determine the quantity of costs to be gathered from each. Due to the fact that loss incidence might transform, insurance providers are in a continuous process of accumulating loss "experience" as a basis for routine reviews of premium demands.

In this respect, insurers carry out a capital development function similar to that of banks. Hence, business enterprises obtain a dual take advantage of insurancethey are enabled to run by moving potentially debilitating danger, and they additionally might acquire capital funds from insurance firms with the sale of stocks as well as bonds, as an example, in which insurance providers spend funds.

For extra on the insurance industry's payments to society and the economic climate see A Company Foundation: Exactly How Insurance Policy Sustains the Economic Climate.

Paul B Insurance - Truths

Discovering exactly how insurance policy works takes some effort, however it's vital to know the basic principles of coverage to obtain what you require. Knowing what's readily available as well as just how it functions can have a major effect on the price you will pay to be covered. Equipped with this understanding, you'll be able to pick the ideal plans that will shield your way of life, assets, and residential property.

When you have something to lose, as well as you can not pay for to spend for a loss yourself, you pay for insurance coverage. By paying cash visit the website monthly for it, you obtain the satisfaction that if something goes wrong, the insurance coverage business will spend for the important things you need to make life like it was prior to your loss.

The insurance coverage company has lots of customers. When a loss takes place, they might obtain insurance coverage cash to pay for the loss.

Some insurance policy is additional, while various other insurance, like auto, might have minimal requirements established out by legislation. Some insurance policy is not needed by legislation. Lenders, financial institutions, and mortgage firms will certainly need it if you have borrowed cash from them to buy worth a whole lot of cash, such as a residence or a cars and truck.

Some Ideas on Paul B Insurance You Should Know

You will require automobile insurance policy if click now you have a car Look At This financing and also house insurance policy if you have a home mortgage. It is typically required to get a finance for huge acquisitions like homes. Lenders wish to see to it that you are covered versus dangers that might trigger the value of the auto or house to decline if you were to endure a loss before you have actually paid it off.

Loan provider insurance is a lot more expensive than the policy you would certainly buy on your own. Some business might have discounts tailored at bringing in certain kinds of customers.

Various other insurance firms may create programs that give larger discount rates to seniors or members of the armed force. There is no other way to understand without looking around, comparing plans, as well as getting quotes. There are 3 primary reasons you ought to buy it: It is required by regulation, such as responsibility insurance for your auto.

A financial loss can be beyond what you can pay for to pay or recuperate from quickly. If you have expensive computer devices in your apartment, you will certainly want to acquire renters insurance coverage. When lots of people think concerning personal insurance coverage, they are likely thinking about among these five major kinds, among others: Residential, such as home, condominium or co-op, or renters insurance coverage.

4 Easy Facts About Paul B Insurance Shown

, which can drop into any of these groups. It covers you from being sued if an additional person has a loss that is your mistake.

Insurance coverage calls for licensing and is divided right into groups. This implies that before somebody is legitimately enabled to market it or offer you with guidance, they should be certified by the state to offer and also give suggestions on the kind you are acquiring. Your residence insurance policy broker or representative might inform you that they do not offer life or disability insurance.

If you're able to purchase even more than one kind of plan from the same individual, you might be able to "bundle" your insurance coverage and get a discount for doing so. This includes your primary house along with any kind of various other structures in the space. You can locate fundamental health and wellness advantages along with various other wellness plans like dental or lasting treatment.

Paul B Insurance Fundamentals Explained

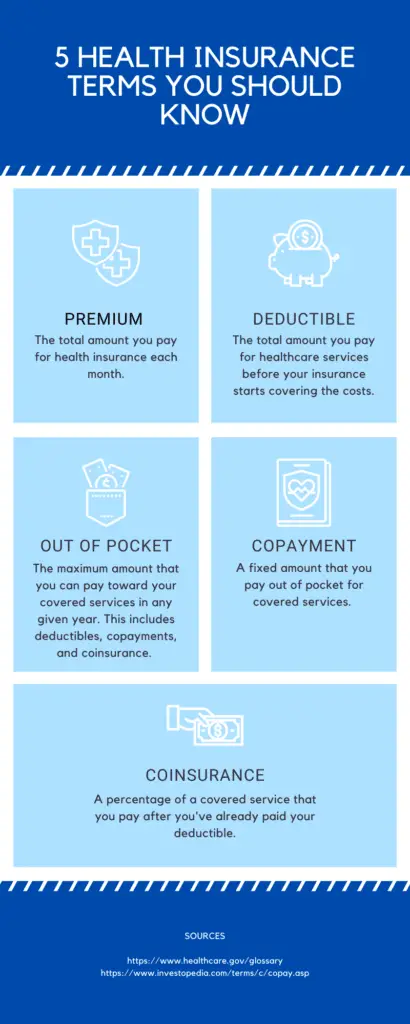

The majority of people do not check out the tiny print in their plan. That is why some individuals finish up confused and distressed when they have a claim that doesn't seem to be going their means. These are some key expressions that you will certainly find in the fine print of your plan.

is the quantity of money you will certainly pay in a case. The greater your deductible, the even more danger you tackle, yet your repayments will be less. Some individuals choose a high deductible as a means to save money. are not covered as part of your policy. It is vital to ask about the exemptions on any plan you buy to ensure that the little print does not surprise you in a case.

If you obtain a really reduced price on a quote, you need to ask what kind of plan you have or what the limitations of it are. Contrast these information to those in various other quotes you have. Policies all contain particular areas that detail restrictions of quantities payable. This puts on all sort of policies from wellness to car.

Inquire about what coverages are limited and also what the restrictions are. You can often request the kind of policy that will certainly provide you higher limitations if the limits received the policy worry you. Some sorts of insurance have waiting durations prior to you will certainly be covered. As an example, with dental, you may have a waiting period.